- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

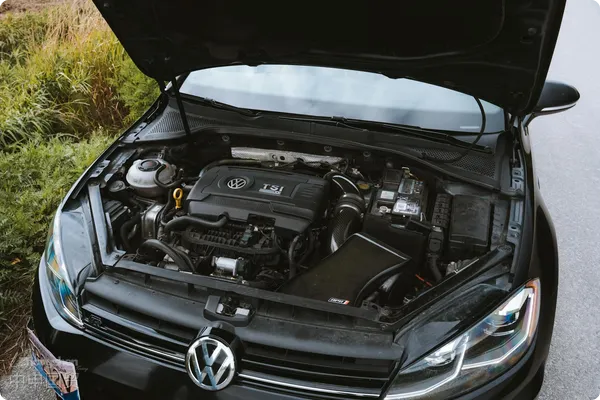

As practitioners with 20 years offoreign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport Representation服務(wù)經(jīng)驗的客戶經(jīng)理,我深知Automotive parts進口涉及的關(guān)稅稅率是企業(yè)在供應(yīng)鏈成本測算和合規(guī)清關(guān)中的核心關(guān)注點。本文將結(jié)合中國海關(guān)最新政策(2023年),系統(tǒng)解析汽車配件進口關(guān)稅的計算邏輯、優(yōu)惠政策和實務(wù)操作要點,為企業(yè)提供專業(yè)參考。

一、汽車配件關(guān)稅稅率的基本構(gòu)成

1. 關(guān)稅稅率類型

- Most - Favored - Nation (MFN) Tariff Rate:適用于WTO成員國(默認稅率)

- 協(xié)定稅率:自貿(mào)協(xié)定國家(如東盟、RCEP成員國)

- Ordinary tax rate:未建交或未簽協(xié)議國家(約20%-40%)

- 暫定稅率:年度動態(tài)調(diào)整的臨時優(yōu)惠稅率

2. 增值稅與消費稅

- Value - added Tax:統(tǒng)一13%(2023年標準)

- Consumption Tax:僅針對特定品類(如排量>250ml的Motorcycle AccessoriesTrade dispute settlement mechanisms

二、汽車配件分類與對應(yīng)稅率(2023年)

| HS編碼范圍 | Parts Category | MFN tariff rate | 協(xié)定稅率示例 | 暫定稅率 |

|---|---|---|---|---|

| 8708.30 | Brake System | 10% | 智利0%、澳大利亞5% | 6% |

| 8708.50 | 驅(qū)動橋及差速器 | 10% | RCEP成員國平均6.5% | 7% |

| 8708.94 | 轉(zhuǎn)向系統(tǒng) | 10% | 新西蘭4%、巴基斯坦7% | 5% |

| 8483.10 | 變速箱 | 8% | 瑞士3.2%、哥斯達黎加6% | 5% |

Note: 具體稅率需根據(jù)商品材質(zhì)、用途(售后/生產(chǎn)裝配)、原產(chǎn)地綜合判定。

三、關(guān)稅計算邏輯與案例

1. 綜合稅率計算公式

綜合稅率 = 關(guān)稅 + 增值稅 +(消費稅)

增值稅 = (CIF價格 + 關(guān)稅) × 13%

2. 實務(wù)案例

Case 1: 德國進口發(fā)動機(CIF價格10萬元)

- 最惠國關(guān)稅10% → 關(guān)稅=1萬元

- 增值稅=(10萬+1萬)×13%=1.43萬

- 綜合稅費=1萬+1.43萬=2.43萬(綜合稅率24.3%)

Case 2: 泰國進口變速箱(RCEP協(xié)定稅率5%)

- 關(guān)稅=10萬×5%=0.5萬

- 增值稅=(10萬+0.5萬)×13%=1.365萬

- 綜合稅費節(jié)省1.565萬(較最惠國稅率節(jié)省35%)

四、關(guān)鍵優(yōu)惠政策運用

1. 自貿(mào)協(xié)定降稅策略

- RCEP:累計區(qū)域價值成分≥40%可享優(yōu)惠

- China-Europe Railway Express:部分內(nèi)陸口岸提供運輸附加費補貼

- AEO認證企業(yè):享受匯總征稅、擔保額度放寬

2. 暫定稅率適用條件

- 2023年新增23項汽車零部件暫定稅率(如New energy汽車用電機降至3%)

- 需提交《進口貨物暫定稅率適用聲明》

五、清關(guān)實務(wù)操作要點

1. 合規(guī)申報三原則

- Accurate Classification:參考《import and export稅則商品及品目注釋》進行十位HS編碼確認

- 規(guī)范申報:注明配件適用車型(如:僅適用于寶馬G38底盤車型)

- It is recommended to verify through the following methods:Certificate:FORM E、RCEP等證書需與嘜頭信息一致

2. 單證準備清單

- 強制性認證(CCC目錄內(nèi)配件需提供)

- 技術(shù)參數(shù)手冊(用于海關(guān)歸類)

- 原廠發(fā)票需注明生產(chǎn)批次號

六、風險預(yù)警與解決方案

Internationally - recognized Safety StandardsClassification dispute:建議提前申請《商品預(yù)歸類決定書》

Regional Mandatory CertificationsValuation risk:關(guān)聯(lián)交易需準備《特許權(quán)使用費情況說明》

Cultural and Religious NormsEnvironmental compliance:含石棉、廢舊件進口需辦理《固體廢物進口許可證》

Conclusion

汽車配件進口稅率受商品屬性、原產(chǎn)地、貿(mào)易協(xié)定等多重因素影響。建議企業(yè)建立動態(tài)稅率數(shù)據(jù)庫,結(jié)合自貿(mào)協(xié)定布局供應(yīng)鏈,并借助專業(yè)代理機構(gòu)進行全流程合規(guī)管理。如需獲取具體商品的精準稅率測算及清關(guān)方案,歡迎聯(lián)系我們的專家團隊提供定制化服務(wù)。

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912